Payslips makes sure that the employee gets an entitled salary and the various compensation promised. It also helps the employer to keep track of detail tracks about the records of any payments.

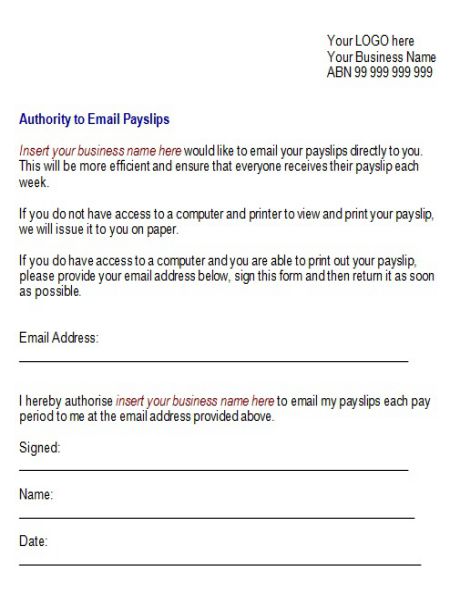

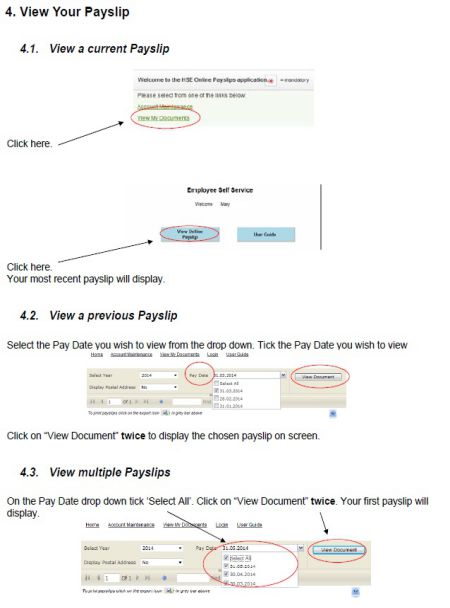

Payslip can be provided to the employee in a paper format or through the electronic way, via email or message or even made it available on the employee portal if the company has so. The electronic slip should include the same details as in the paper payslip.

The employee must usually receive the payslip within 1 business day after the salary credited even though the employee is on leave. Employee’s leave details can also be mentioned on the payslip but it’s not mandatory. In case when the employee asks for the leave details the employer has to tell him about the balance leaves.

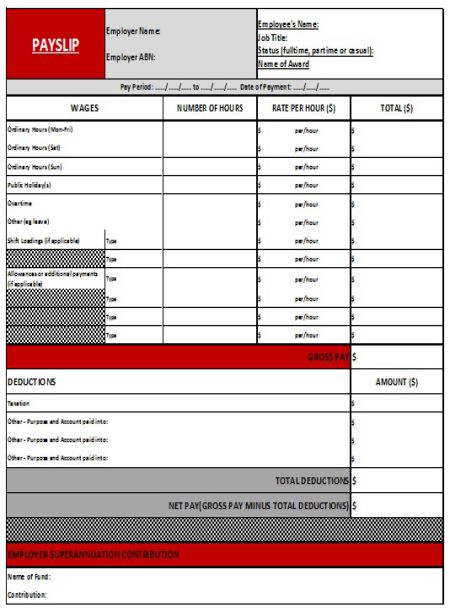

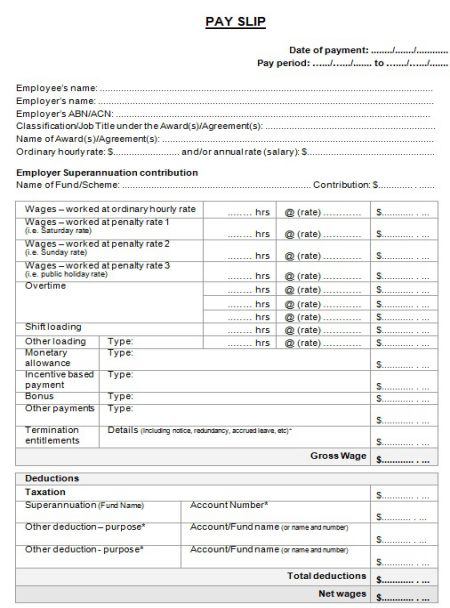

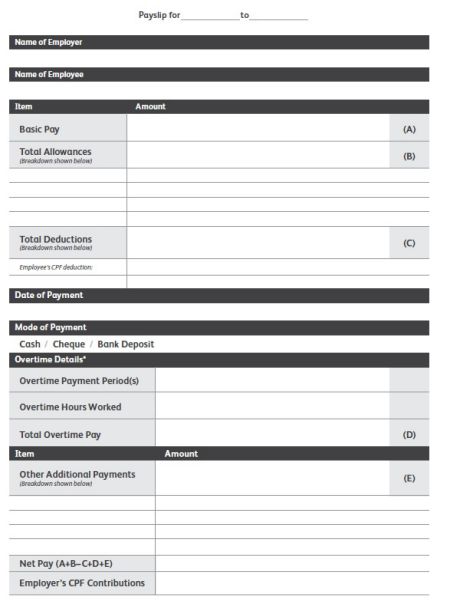

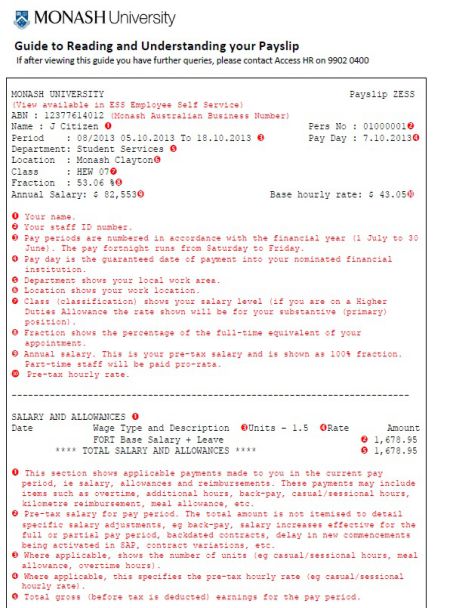

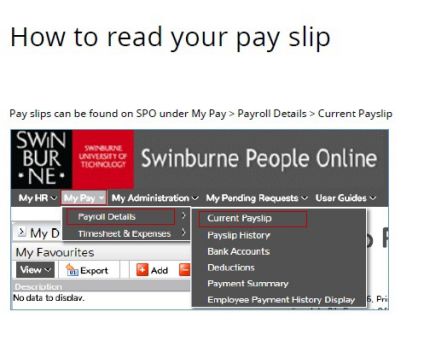

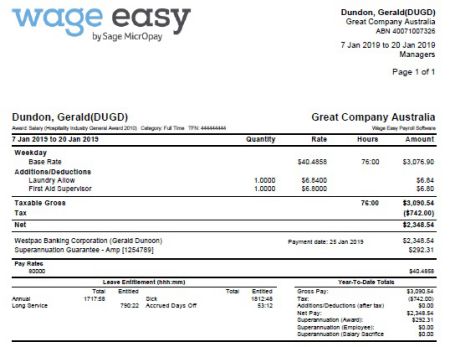

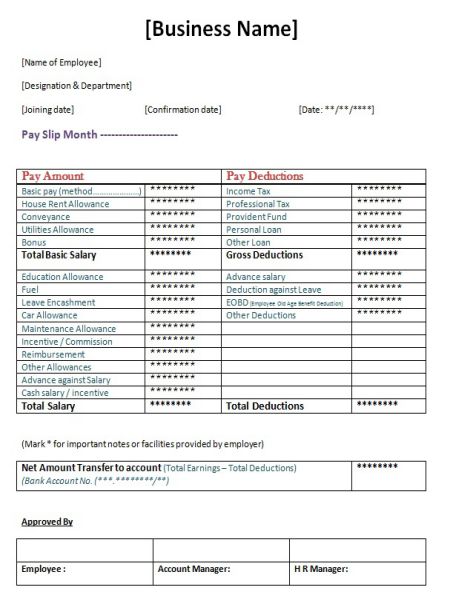

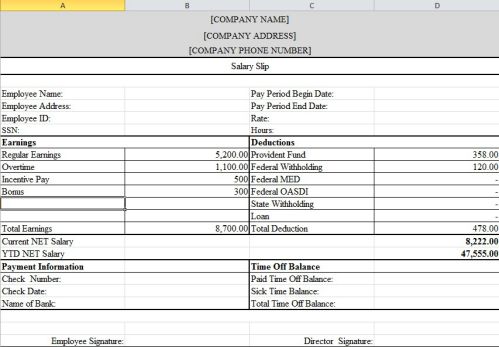

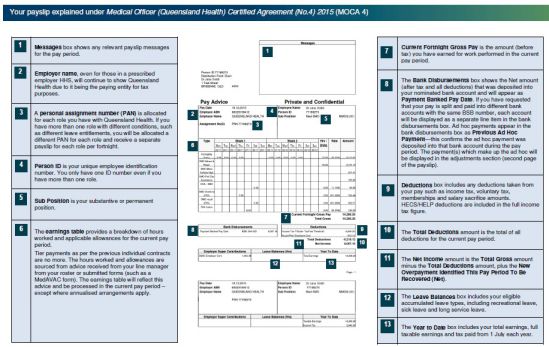

Payslip Sample Australia

To develop Payslips for your company you can use the payslip template available which helps you to make your payslip by designing and formatting in a way you want which saves your time and effort.

The payslip has to be designed in a professional way to maintain your company standards as your employee presents it as proof of salary to get a loan and other financial assistance. As every employee needs financial help during his life for some or other reasons, if the payslip you provide does not have the details about the employee then the bank may reject the offerings which may create a big problem for your employee. This may also affect your company’s reputation.

Therefore, take the help of these templates and avoid such issues. Download them for free and design to personalize per your standard template.

Let us deep dive to understand in depth about the payslip template, legal proceedings in Australia.

How to use the Payslip Templates

To make your payslip there is a certain easy step that has to be followed. Select a template of your choice. Find the place to fit your details such as the name of the employee, the designation of the employee, company name and contact details, etc. After customizing the template according to your needs you can now print the slip. The format can be stored in Doc or PDF format.

However, we make your life easy and get ready to use these free templates without investing much of your time.

By using these payslip formats in template form given here you can be sure that they are common across Australia. Thus no one can question you about the standards which also mean no issues during financial assistance from the bank for your employees.

– Components

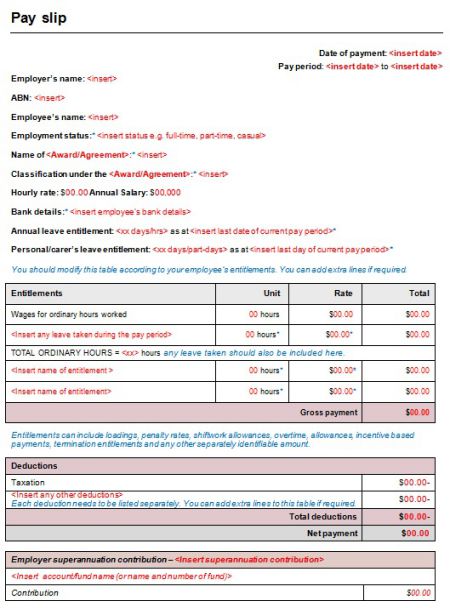

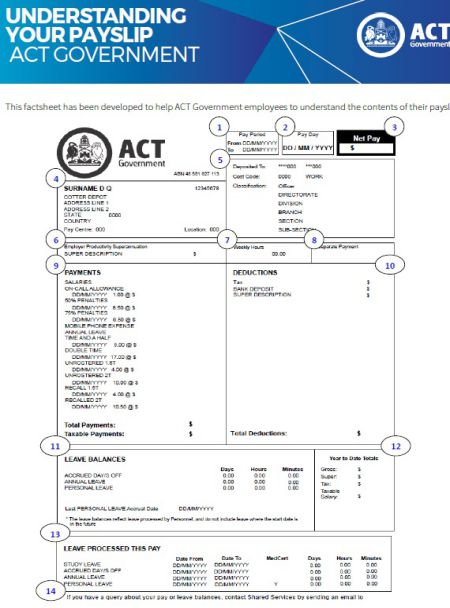

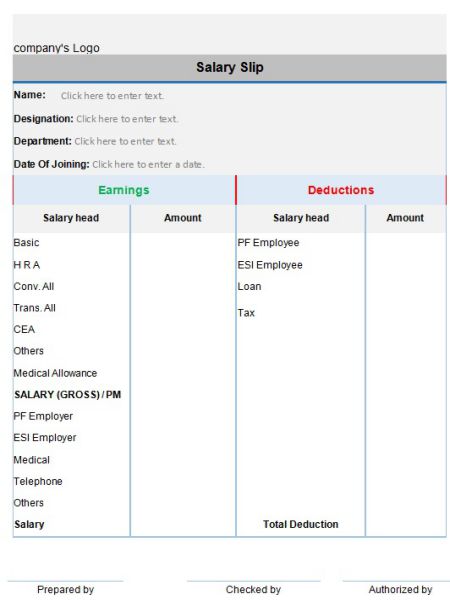

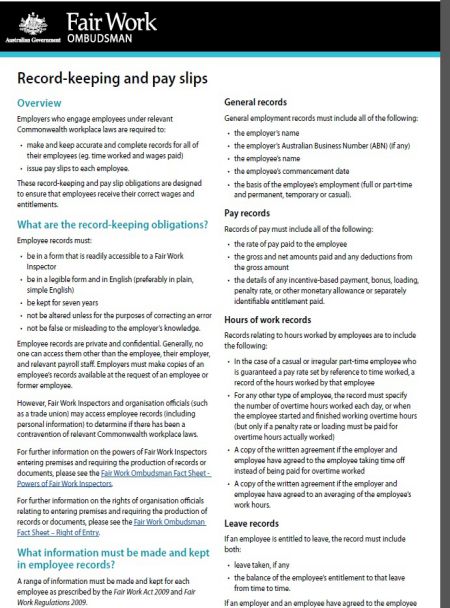

Payslip must have details of the employee’s gross and net pay and other additional pay if any. Here is the list of details that has to be included in the slip.

- The name of the Organisation and the name of the employee.

- Australian Business Number of the Employer

- Salary date or period

- Duration of employability of the employee with the organization

- Salary – Net and Gross

- For hourly

wages employee include the following:

- Normal hourly wage

- Number of hours worked

- The total amount paid at the agreed rate

- Normal hourly wage

- Any casual allowances, bonuses, incentives, penalty or other paid entitlements that are different from the employee’s hourly rate received. For example, a note can be mentioned on a payslip regarding the other casual benefits received.

- Amount paid while ending up the employment

- Deduction

made in the salary while leaving:

- Amount received after deduction

- The account holder’s name and details on whose account the fund is transferred.

- Amount received after deduction

- Any separation

contributions paid for the employee’s benefit, including:

- The amount paid as compensation while leaving in

terms of service bonuses.

- The account number to which the payment of leaving compensation is transferred.

- The amount paid as compensation while leaving in

terms of service bonuses.

Laws that govern payslip in Australia

Payroll and tax implementation are based on certain laws and regulations that the foreign businesses must be aware of in terms to follow them. Below is the list of important information to know.

Basic factors of Australian payroll

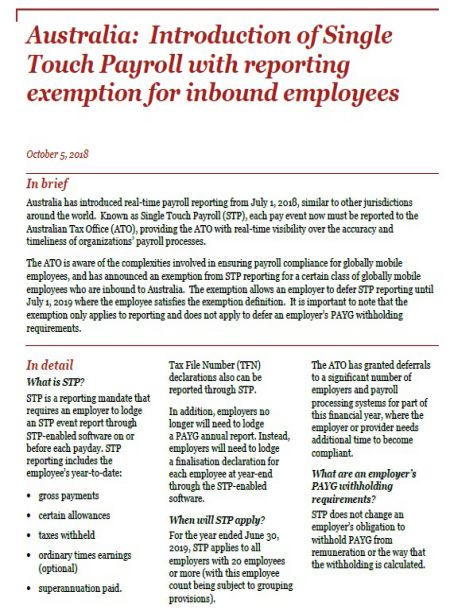

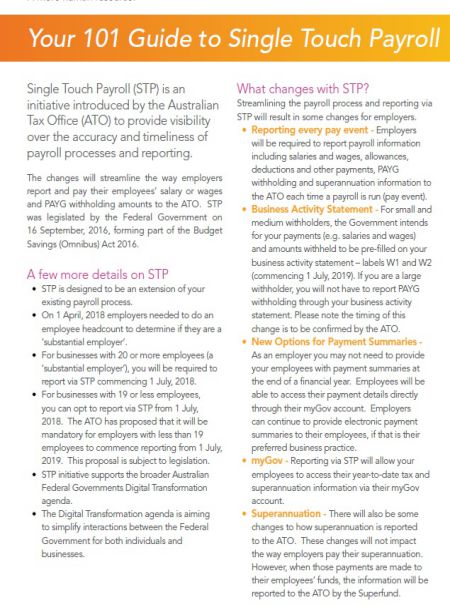

ATO stands for the Australian Taxation Office. This agency collects revenue on behalf of the government. By introducing STP i.e Single Touch Payroll, ATO brought a major change in Payroll methods. The ATO is not only responsible for revenue collection but along with that, it has to give support for superannuation and taxation to all citizens of Australia.

Every business has to obtain the ABN – (Australian Business Number) and TFN – (Tax file number) from ATO for operating as an entity and also for the employee recruitment process.

The tax is levied on ATO taxation rates and also depends on the residency of the employee. Employees are entitled to claim deductions or additions in the pay if any through payroll.

The companies operating on a large scale and entitled to paying huge taxes have to pay the taxes to the ATO in not less than 7 days once the funds are collected by the employee. Or else the taxes have to be paid monthly before the 21st of that month.

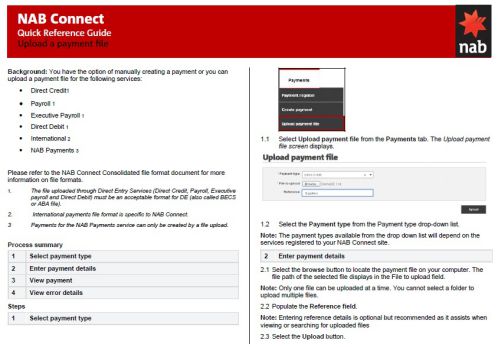

The Employers contributions towards superannuation for their employees have to be paid on or before the 28th of the subsequent month to the authorities for every quarter. The payment can be done via any bank account, it is not necessary to make the payments through self country bank to the authorities or employees.

The financial accounting year in Australia is from the 1st of July to the 30th of June every year.

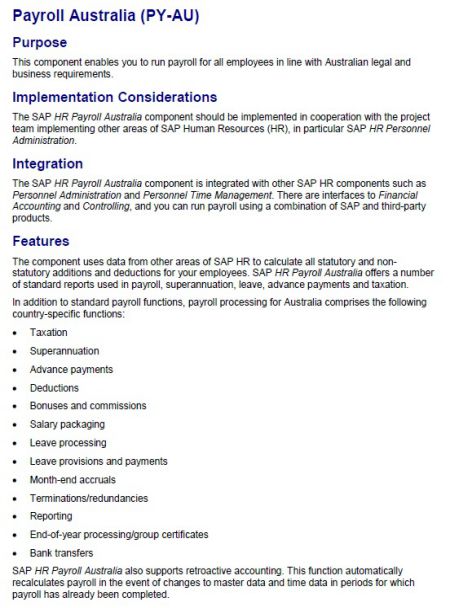

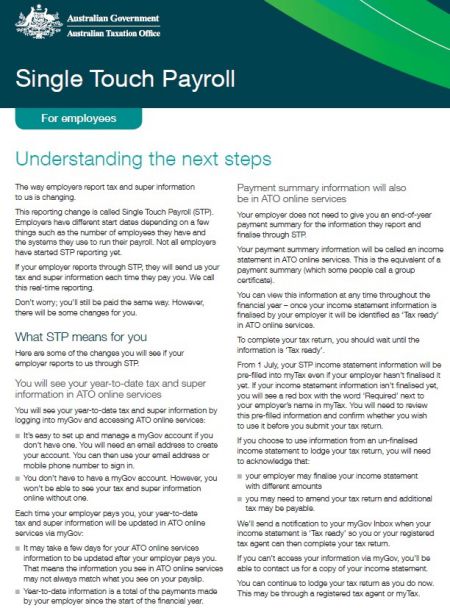

STP – Single Touch Payroll

This is the latest technology through which superannuation and tax details can be reported to the authorities. Earlier the information was submitted yearly, but due to this technology, they have to submit the digital report in a detailed form on every single payday.

STP dreams to reduce the manual efforts while submitting data in terms of Pay As You Go (PAYG) cover-up and departure offerings to the ATO. The data is processed using software that is approved by the Australian government and listed under Australia’s Business Software Industry Association.

The employers can pay the taxes held from the wages of their employees to the government in concurrence when they submit a report regarding their payroll using this new technology known as Single Touch Payroll.

Most of the employees receiving wages are either paid weekly or monthly or sometimes daily through online payment options, cash or through cheque. Payslips have to be made available to the employee within one business day after the payment is done, either in physical paper format or in an electronic way.

Are payslips a legal requirement in Australia?

In Australia, it is mandatory to provide the employee with Standard and legally acceptable payslips. Also, it must be given to the employee immediately after the payday and not exceed the next workday.

The employer has to follow this entire act while providing payslip such as

- Fair Work Act 2009 (Section 536)

- Fair Work Regulations 2009 (Reg 3.46)

or the regulations of that particular state in which business is operating. FWO made an announcement in 2014 of visiting almost 350 business entities to inspect the payroll maintenance system and the payslips provided by them across Australia.

Whereas it’s not mandatory to give payslip to the employee who is award free but it helps to avoid any confusion in case any dispute is raised by the employee or other authorities. So it is suggested to provide payslip as a part of good business practice.

Note: If any present employee or former one requests access to his records of employment in writing, the employer has to grant him permission to check his records.

Types of payslip templates

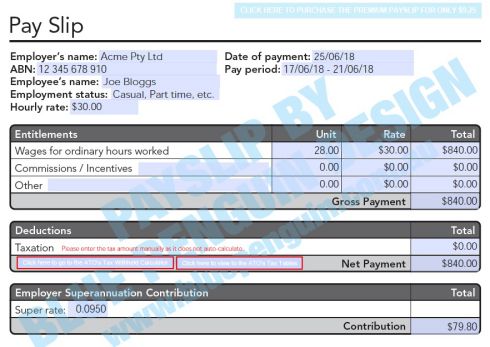

Weekly payslip template Australia

This template is used by organizations that make weekly payments. The employee is provided with a single page payslip after the payment is processed for one week of work. It includes details such as a

- number of hours work in a day

- total weekly hours

- sick leave

- holidays taken

- the amount received as wages in total, etc.

- total weekly hours

This template saves efforts of calculations as it is directly done using formulas.

Monthly payslip template Australia

This template helps to manage the monthly payment of your employees. The Monthly payslip is the same as the weekly slip but calculated for a month in accordance with the information of the employee, a number of hours work, etc. The only difference is that it contains the information for 4 or 5 weeks of work done based on the day in which the week begins.

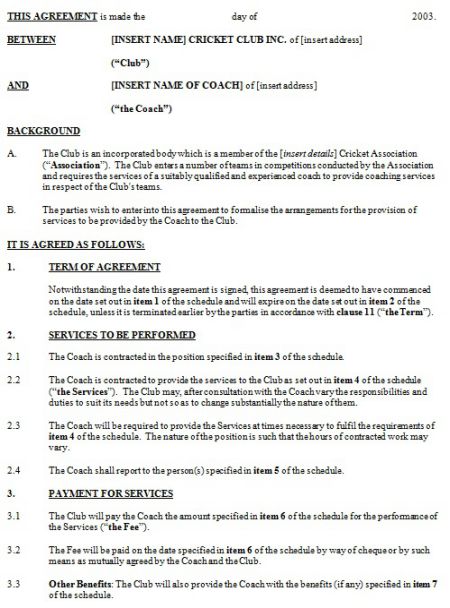

Contract employee payslip template Australia

Unlike regular employees who work weekly or monthly, the contract employees will work for a stipulated period. Their wages are fixed and hence the template differs. You can choose this free template which will replicate a contract employee payslip which does not contact leave allowance. This means the pay is deducted for every single leave. Also, contract employees are not eligible for superannuation. Look at the template to understand the difference proceed downloading to use it.

Simple payslip template Australia

This is a blank template and you can edit to use it for a weekly, monthly, or contract employee payslip. Simply include all the details you wish to and customize the template. However, remember to refer to the legal terms as mentioned above when you choose to use a blank template.

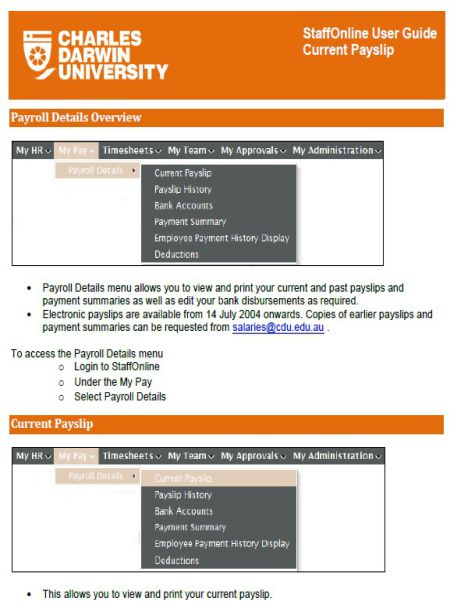

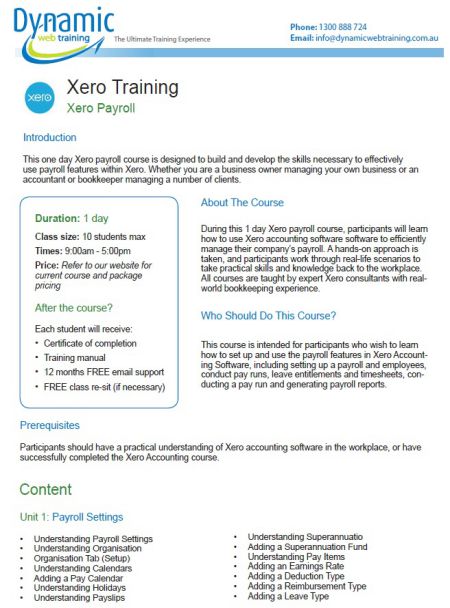

Xero payslip template

Xero is a payslip generating tool and it charges you after the free trial. Hence we have provided you with a free sample for your perusal. However, find below the steps to use the Xero tool to make your payslip.

- Pay template à Include the pay items

- Payroll menu à Choose Employees

- Open employee details by clicking their name

- Click on Pay Template tab

- Choose the following

- earnings

- deduction

- superannuation

- reimbursement type etc and to add to the template

- Finally, save the template

Myob payslip

Similar to Xero you can also use MYOB. Also, find the templates here for you to use them quickly.

- Click on payslip form:

Setup menu à Customise Forms à Pay Slips à payslip form à Customise.

- Select Fields in the customize tab

- Choose the Payee field then click OK.

- Fill the name and other details

- Press save

- Press OK

Top 5 Payslip generator apps online

With the help of this online generator, you can create payslips and for free. Payslip generator is the part of the payroller and is easily accessible.

Payslip generator will make a payslip for you automatically once you put details in the pay run. There is no need to keep entering the data again while generating payslip.

You can also change the settings according to your needs in the payroller. You can customize your payslip as you like. Although this app also helps to adjust automatically as per the data entered, it gives complete freedom to the user to control it.

Once you are done creating your payslip, you have complete access to download, share or print the document. Without taking many efforts you simply have to click on the option of your choice and you have your payslip with you.

This payroll is cloud-based software. Due to which it can be easily used whenever and wherever you need to create payslips. It gives complete flexibility to the user to maintain their payroll activity.

These payslips are created abiding by the FairWork’s policies. Your payslip will never be questioned by the authorities or financial institutions. As the payslip generator maintains complete standards required to make it avoiding any issues in the future.

Payroller is designed especially for small businesses that were ignored by STP software. It can be used for free in any device.

You can create your professional Payslip using Paystub for free within minutes. Payroll payslip is created for free on this site. Print your PayStub professional payslip instantly. You can access a variety of templates and get the calculations done accurately. Just

Create à Save à Download.

Xero is an accounting software wherein you can share your work with employees, connect with your advisors from anywhere at any time. You just need to add the required apps in the software to get a complete business solution.

Xero even maintains your everyday bank transactions and helps you to maintain the cash flow which helps to keep everything in hand while filling tax.

It keeps the complete record of your day to day spend and presents the information in graphical formats such as charts, pie diagrams, etc.

Optimize the time needed to pay invoices through online by pressing the pay now button for payments, Xero’s feature of automatically chasing outstanding pay will set reminders.

You can choose the intervals of when the payment is to be done, whether monthly, weekly or bimonthly.

Use the Xero software 30 days free trial and find out the suitability of Xero payroll according to your needs. You can use the demo for setting your own payroll.

Flexible templates can be created using keypay. You can add a logo, select your font, display and hide information per your choice. Also, you can send messages for email notification.

It is quick and easy to download and print the payslips for hundreds of employees in not time.

Convenient for employees. With the help of KeyPay, you can send notifications to your employees once you are done with the pay run settings.

Employees have easy access to their payment history and payroll slip at any time and from anywhere over the internet.

Through this app, you can get your payslips within ten minutes and less. You have time to focus on things that are more important to your business.

Best features of Easy Payslip

- Make the payslips and email them.

- Track the rights of employees

- Track compensation received by the employees.

- Customized Data

- STP payroll complaint

FAQs

There are two ways to make your payslip. One is to quickly download from here and fill the details and print it. The second is to create online using any of the online tools given above. Click on the link and follow the process to start making payslips. All you need to do is to enter your employee details. Ask for a demo from the providers and take your next step forward.

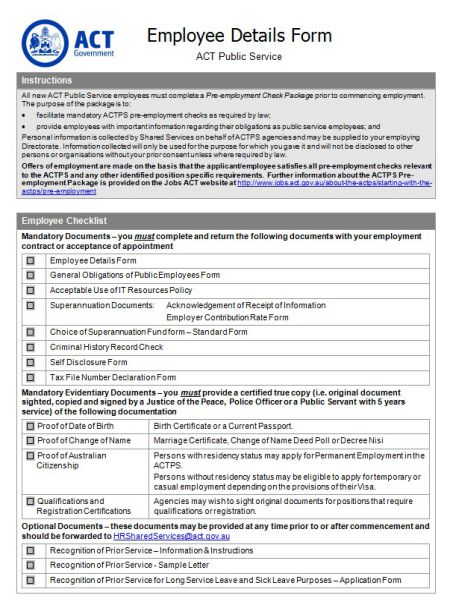

Every employer who reports through (STP) will send the detail ww.ato.gov.au every time they log in. Payments will be made anyway – however, there may be little changes in your account. New employers can complete some of their workforces commencing forms online. So you can download it from there.

The total pay after deductions and Gross pay;

• The date on which payment is given;

• Duration of the pay

• Bonuses, compensations, expense remuneration, penalties, etc;

• Deductions in pay;

• Contributions of the employer to any superannuation fund;

• Name of the organization, ABN number

• Name of the employee

In the digital era, handwritten slips are not accepted as legal documents. The banks simply reject the loan as they don’t accept it as proof of earnings or have to attach additional documents that make the process stressful. Payslips must be electronic or printed hard copies with detail information about the company and employee.

Collect employee information.

• Collect all the business information required for payroll

• Track your employee’s time using the attendance management system.

• Make payroll calculations

• Make deductions if any

• Make employee payment

• Pay your taxes on time

Legally right payslips are mandatory in Australia for all businesses and must be given to the employee. It must be given immediately after the payday with a time window of one day.

In the current world, you may give payslips on the web or through email. In any case, you should guarantee that your workers get these payslips – regardless of the configuration. Providing payslips and these duties as a business will be recorded on the Australian Government Fair Work Ombudsman site.

For processing home loan minimum least two latest month’s payslips are required.

The following are the basic necessities that payslips should meet which will be acknowledged by a bank:

• Must be dated under about a month from the date of use (old payslips are not acknowledged).

• Period of payment should be recorded and this will include the compensation day.

• Must incorporate employee name as the worker, your YTD pay, employer name, their Australian Business Number (ABN) as well as Australian Company Number (ACN).

• Present your assessable salary and net pay

• All conclusions are clarified including charge, high training obligation (HECS-HELP), superannuation commitments and any obligations you’re paying directly from your compensation, for example, pay expenses

In the case of self-employed professionals, they don’t get a payslip. They can submit a letter to prove the income while applying for the loan. The bank statement can be used with a letter.

Final thoughts

Finally, remember that the formats for payslips should be straightforward and adaptable with the end goal. It must be editable allowing modification in accordance with the legal terms. At the same time, the information included must be justifiable to the beneficiaries. Also, the payslip provider must realize that the objective is to fulfill the need of the beneficiary.

It is prescribed to utilize the company letterheads to print the payslip and to make it increasingly official. Make sure you provide the organization’s name, address at the top. Next, ensure to include the subtleties of the worker whose compensation is paid like their name, month, and designation. Give details of the net sum paid as wages to the worker. Allow some space to mention details of the check if that is the mode of payment. Signatures of both parties are mandatory. Seal of the company must be included.

We are glad to offer you free templates and all details pertaining to payslip in length. Use the templates and refer this article to abide by Australian law to provide payslip to your employees.