Are you looking for a simple way to record your work details and get paid? Then the contractor invoice is the solution.

Well, if you are still searching for an invoice template that works as per your requirements, then we can definitely solve your problem easily. Here are some collections of templates mentioned so quickly download it, alter it according to you and then simply use it the way you want to!

Contractor Invoice Template – Australia

Among the diverse categories of INVOICES ensure which invoice to utilize.

Checkout our free Australia Tax Invoice Templates

If your trade is:

- Listed for GST (Goods & Services Tax) you should use tax invoices.

- Not listed for GST you should use fixed invoices & do not include the word “Tax Invoice”

Tax Invoice presents the GST which was included along with the price of all the goods and services sold out if your trade is listed for GST. For claiming credit for GST in the selling price, your customers who are listed for GST require a tax invoice when you sold goods and services of above $82.50 comprising GST.

There should be no GST mentioned in the Tax Invoice if your business is not listed for GST & in case your customer asks for a Tax invoice and you can do the same by adding “CHARGED NOTHING FOR GST” or you can also mention GST amount as zero in the Tax invoice.

Why do you require a template?

In order to find relevant information, applying an ordinary blueprint for the tax invoice will assist you in making it simpler for your clients. Ensure that you have included all the significant requirements if you are intending to form a standard format for your trade tax invoices.

It completely depends on you but give due attention to the following details:

- Logos of your business

- Color of the paper

- Style of the Font

- Marketing details

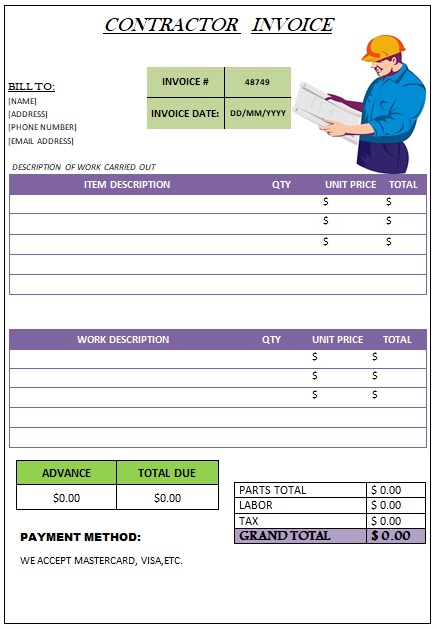

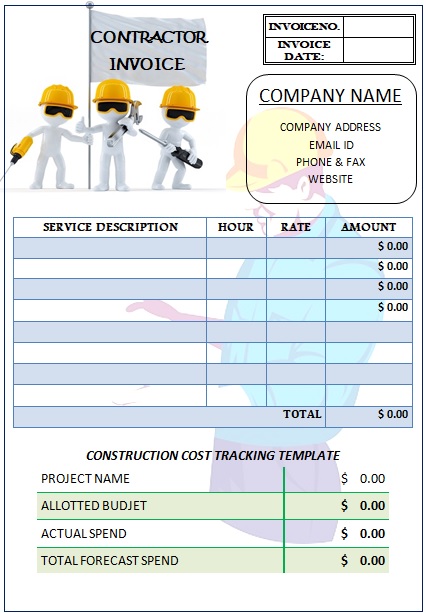

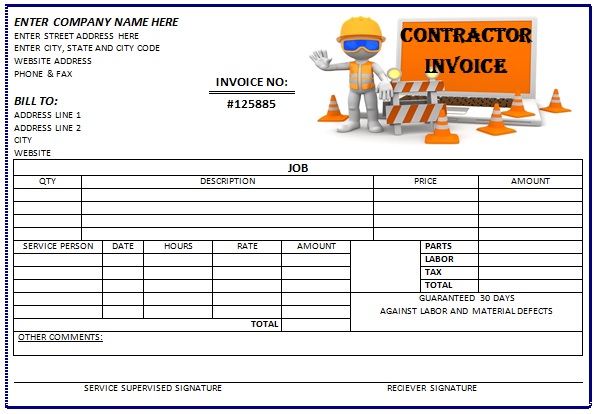

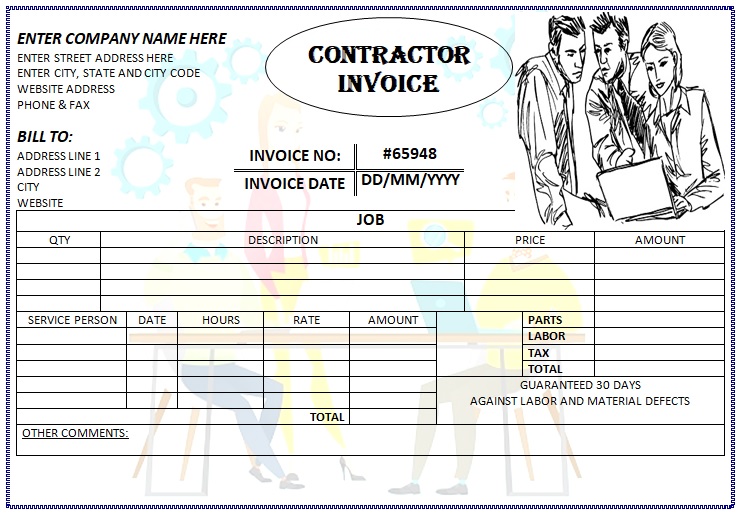

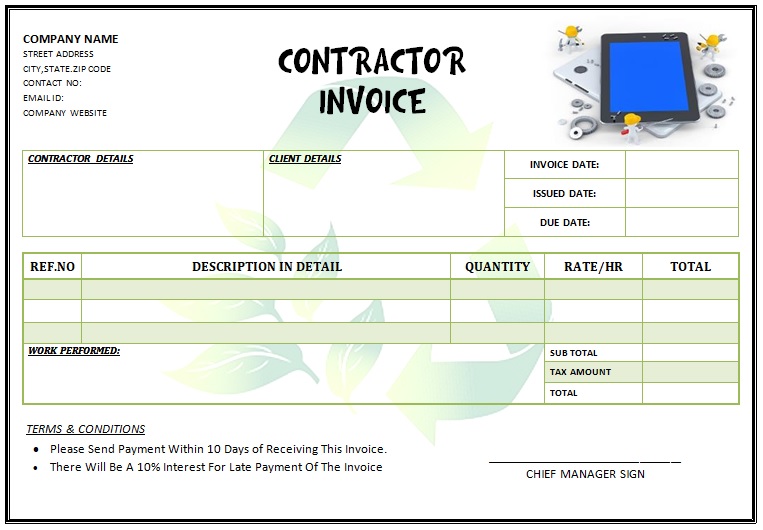

Components

You are required to mention various information in the contractor invoices and also in a systematized way. You must finally make sure that you’ve added the title as a contractor invoice.

In order to be valid, the following information must be mentioned in your tax invoice.

There might be further needs reliant on how you sell and the whole price of the tax invoice. Yes, a contracting business will include both labor and purchase costs.

Your tax invoice must mention the following things for sales below $1000 comprising GST: –

- The term “TAX INVOICE” as the heading.

- Being a seller, your identity like the name of your trade (contact information are elective but suggested)

- Your ABN (Australian business number)

- Date when the invoice was issued

- A detailed sold goods list along with the price as well as quantity

- GST amount paid (if any) and you should separately mention the amount of GST on each product or if the amount of GST is accurately one-eleventh the whole price then you can add a sentence like “GST is included in the Total price”

- The level to which every product sold involves GST, you will meet the necessities if you:

- Either mention the amount of GST for each product, or

- Vividly mention that the whole price contains GST

For sales of more than USD 1000 along with GST, Tax invoices required to show customer’s ABN or identity. All the above-mentioned things must be in a layout which is simple for you to mention when required as well as straightforward for clients to read & understand. You can make use of our printed invoices if they want the invoices physically.

The major segments are listed out for you when you are using our template of contractor invoice. This shows your customers that what they are paying for and it also helps you in keeping a note of the work and the purposes of accounts. Also, it allows reminding your customers of the whole price & how they can give you money for your assistance.

How to fill it up

Explanation of Work, Materials & Labor

The explanation of the work must be in concise format but it must be in detail also. Show a particular and not just the usual kind of profession where probable. In the future, when you might refer to your invoices the information will remind you what you did. Also, the explanation must be easily interpretable by the users to know what work exactly was done!

Explanation of Work, Materials & Labor

The explanation of the work must be in concise format but it must be in detail also. Show a particular and not just the usual kind of profession where probable. In the future, when you might refer to your invoices the information will remind you what you did. Also, the explanation must be easily interpretable by the users to know what work exactly was done!

ESTIMATING THE WHOLE PRICE:

Your invoice should contain the whole amount of all the labor & material in the middle of your invoice. Mention the finalized price which is remaining and after that include the taxes then minus the deposit if it is mandatory. When the whole price is remaining you might want to mention that and the kinds of payments you acknowledge so that the client has all the information he/she requires paying you!

You should make an invoice in such a way that your customers will be able to understand and read it clearly and also that you will be satisfied with it. Well, we definitely can assist you!

So, in order to create a contractor invoice that meets your business requirements, check our templates and get going. You’ll be startled to see how simple and undiplomatic is it to create to mail it to your clients.

Do’s and Don’ts

- Mention the ways in which you accept payments and terms of payments.

- Deliver a category of payment alternatives & mention the same.

- Be clear about your products so that any argument may not occur after the client views the same.

- Do not mail improper & unfinished invoice to your clients

Laws that govern contractor invoice in Australia

There are some numbers as well as enrollments you might require no matter which trade you are serving as a contractor.

- TFN – TAX FILE NUMBER

For solo traders utilizing your personal TFN is sufficient. In case if you are in a partnership with someone and you’ve your listed organization then you will require submitting an application for a separate TFN.

- ABN – AUSTRALIAN BUSINESS NUMBER

Your ABN must be mentioned on your every document related to your business. Spend some more funds on your invoices.

- TAX – GOODS AND SERVICES

Being a contractor you must apply for GST if:

- Your trade or organization has a GST revenue of more than USD 75K

- You want to demand petrol & diesel tax credits for your organization or trade.

Listing for GST is an alternative choice if you don’t meet the above requirements of the above-mentioned groups.

Sole Trader Contractor Invoice Template Australia

Some businessmen require to mail invoices whereas some individual businessmen do not require it. Whether or not you have the requirement for the invoice, it is important to know about it. Down the line, it will make you a professional and fetch you more offers. You always should render an invoice that is to be paid, if you are functioning on a contractual basis.

Electrical Contractor Invoice Template Australia

In order to make new clients and keep a track invoice is required. However, numerous electrical contractors undervalue the significance of invoices. Apart from your work, it is the fact that invoices are really an imperative aspect because a well-designed invoice confirms that you are a certified trader.

You have to ensure that invoices are responsive to every user which makes it simple to understand and read. Hence, while making invoices you must ensure that invoices are informative but easy enough to understand by your clients for what you are charging for.

Independent Contractor Invoice Template Australia

Being an independent contractor, it is a must to have a trustworthy & formal method for payment collection for the services you deliver. You can mail invoices for the services you are delivering by using our contractor invoice template which is free for sure but check you have mentioned all the necessary information required to be mentioned. With the help of our independent template for your contractor invoice, make trade easily.

Sample Invoice Template Self Employed Contractor Australia

This pattern of the invoice is specifically created for contractors. It’s a very simple but decent pattern where there are no columns available but still, you have all the segments needed for a normal invoice template like quantity, units, per product price, whole price, etc. The explanation sections are large enough to describe your services.

Invoice Template Australia – Contractor Services

A contractor delivers numerous services like redesigning homes, consultation of business, teaching services and much more but despite any particular services, every contractor is required to get paid for the services they deliver to their clients and therefore, our downloadable template of contractor invoices which is absolutely free. All that is required is, you request for payments in a formal way by providing a proper format to estimate hours, as well as days worked according to your service charges.

Invoice Template Australia – Contractor Services Superannuation

For contractors, it is important to understand the difference between employees and contractors because it can influence your responsibility of tax and pension, intellective property proprietorship & insurance. Being a contractor, the most relevant decision you’ll make is how much to get paid for your services. It’s up to you whether you’ll charge on an hourly basis or you’ll charge on a fixed rate. The price details to be included are mentioned as followers:

- Insurance

- Tax

- Workers compensation

- Leave provisions

- Pensions

- Training & licensing price

Australia Invoice Template Sub Contractor

There is only one distinction between templates of invoices used by CIS subcontractors and templates of invoices used by further kinds of freelancers. That is CIS Invoice templates require to mention CIS deduction. Usually, there are 03 prices of CIS subtraction like

- 20% of listed subcontractors

- 30% and 0% unregistered and non-listed subcontractors with “Gross Payment status”

If you meet the criteria for gross payment status, then it is not required to mention anything about CIS in your invoices.

The contractor to whom you are delivering your services does not require deducting anything from your payment; Although, you need to ensure that your template of invoice contains the following things if you utilize either 20% or 30% price:

- The deduction price of CIS

- The whole amount which is valid for CIS deductions (For e.g. the rate of labor)

- The whole amount which is to be subtracted

Contractor Invoice Template Australia ABN

Usually, while making an invoice for goods/services, traders are required to estimate an ABN they’ve delivered to their clients. After all that said, everyone who requires to mail invoices for getting paid will not need an ABN to do the same.

Contractor Invoice Template Australia Ex GST

It is relevant to mention in your invoice whether GST is added or not. If your price contains GST then you must provide a tax invoice that mentions that the complete amount of GST it contains. But, if your price does not include GST, then you are required to provide an invoice that vividly shows that “There is no GST included”.

Businesses obtaining less than USD 75K of revenue annually are not required to charge GST.

Contractor Invoice Template Australia Excel

It is quite difficult if you do not know how an MS Excel invoice works. It is the best tool for making invoices for your trade as it offers so many features. So, go and download the template of the contractor invoice which is free and begin to create invoices immediately.

It doesn’t matter what your business is about, invoices are an important method that allows you to meet your goals and not merely add record maintaining details and communicating with clients. It is very easy to make a standard formal invoice with free excel templates of invoices that can be adaptable to fix for any services. Every trade will get benefit in improving the layout and functionality as all estimation for the goods and services you sell. MS Excel invoice templates would be easier when compared to MS Word invoice templates.